Using the right NFT trading strategy is important for anyone who wants to succeed in the market. Non-fungible tokens (NFTs) have become popular lately and have made millions for investors who buy tokens that are appealing to others.

Table of Contents

The term NFT may seem like a new concept to many since it became increasingly popular late last year. However, NFTs have existed for years and their history dates back to 2012-2013 during the inception of Coloured Coins. Coloured coins are smaller denominations of Bitcoin and were used to issue real-world assets like real estate on the blockchain during the early days of cryptocurrencies.

Unfortunately, Bitcoin’s scripting language limitation was not enough to sustain the application, thus reducing the fuss around these tokens. The concept of Coloured Coins opened up lots of possibilities and laid the groundwork for NFTs.

Fast forward to the present, NFTs are on everyone’s lips in the crypto space, with the asset class recording groundbreaking feats. Over $3 billion worth of NFTs was traded in August 2021, and the industry continues to witness rapid adoption.

What is an NFT?

Non-fungible tokens are digital assets on a blockchain with unique identification codes that help differentiate them from each other. NFTs’ distinctive attributes make it impossible to be replaced or exchanged.

The tokens can be used as a representation of real-world assets such as real estate, digital artwork, etc. In recent times, several artists have adopted the NFT initiative to monetise their previous works, while collectors purchase the tokens as a store of value.

Why Invest in NFT Collectibles

There are several reasons why NFTs have become one of the hottest topics in the cryptocurrency space and we’ve highlighted a few of them below:

- Promoting Content Authenticity

Since NFTs give content creators the opportunity to tokenize their works without being scared of copyright, investing in the asset class would give other artists the confirmation that their works will be protected.

Although there are a few reports of artists complaining over the fact that their works have been tokenised without their consent, experts believe that this issue will be addressed in the near future, as new features are constantly rolled out to make the NFT marketplace more efficient.

Before promoting your favourite artist’s work via your investment, ensure that the NFT marketplace you are buying from has several content creators’ validation and high security credentials.

- The NFT Market Is New

Even though the history of NFTs dates back to 2012, the concept became popular late last year when groundbreaking sales including the famous Beeple Art, which cost around $69 million, were made. With NFT considered new to many cryptocurrency enthusiasts, chances are the market will exist for decades and early investors will reap bountifully.

Getting in early in space will place you in a good spot to enjoy the lucrative benefits that will come in the future. The fuss around NFTs is just getting started and more people will be joining the space soonest as the adoption of cryptocurrencies continues to increase.

The value of NFTs is tipped to soar in the short term as more people, including investors and content creators, continue to get involved in the space.

- Profit Opportunity

There have been numerous reports about people who got rich from buying and selling NFTs. Sometimes, these tokens are even given out for free, and eventually become valuable as more people are attracted to the rarity of the asset. NFT investors with the right strategy stand a greater chance of making reasonable profits in the short and long-term.

Why You Should Have an NFT Trading Strategy

NFT collectibles have proven to be valuable lately and is now considered a profit making venture. Before investing in them, though, it is advisable to develop a trading strategy that would help you make massive profit.

Like it or not, the sole purpose of trading any asset or commodity is to help the trader make gains, and not adopting the right trading strategies could limit the amount of profit.

Having an NFT trading strategy would:

- Gives you a huge return on investment

- Guide how you approach trades.

- Help you remain focussed regardless of market conditions.

- Establish a guide to help you evaluate your previous performance.

Basic NFT Metrics

The latest boom in NFTs has prompted the launch of numerous projects claiming to give investors good value for their investments. While this is healthy to an extent as it helps retain the fuss around NFTs, it has also created a problem of choice for traders.

Most traders may be wondering how to select a valuable NFT project from the unending list to help them amass significant profit from the market.

If you fall under this category, then this section is for you. We’ve compiled four basic NFT metrics to guide your NFT investment choices.

- Estimated Market Cap

Analysing the project’s market capitalisation is a good way to select the right NFT project. NFT market cap does not move faster like other cryptocurrencies (fungible tokens) due to the way they are programmed.

A good platform that gives a concise measurement of NFT market cap is Rarity.tools, you may want to consider checking them out.

When a project has a high market cap, it implies that there are several owners of the NFT who are willing to pay a higher price to obtain the NFT collection from another.

- Diamond Hands Balance

Another metric to consider is the number of holders who have not sold their NFT collection. They are termed as long-term believers in the project because of their commitment to hold onto the token irrespective of what happens. The higher the diamond hands’ balance, the more possibility that the project has long term potential. Nansen Analytics provides the right platform for this analysis.

- Number of Unique Holders

This metric takes into consideration the number of addresses that hold an NFT. When the number of addresses holding the token is high, it indicates a larger community, which would contribute in marketing the product to other potential investors and also boost the token’s value.

Dune Analytics’ NFT Comparison dashboard might come in handy in verifying the number of unique holders for an NFT.

- Volume Traded

This shows the amount of tokens traded for a particular project within a specified period. The higher the volume, it suggests that the project is in high demand from investors. You can check various NFTs trading volumes on popular marketplace, OpenSea to see if the project is in high demand. If you’re using a different platform, this data is usually available on the data page for the NFT.

Factors for Evaluating NFT Collectibles

Based on the fact that people still consider NFTs as a new crypto market, trying to evaluate them may be tricky. Here are five key factors to help you evaluate your NFT collections:

- Age of NFT

Even though NFTs became increasingly popular late last year, the market has existed way before that and there are projects that have survived the storm thrown at crypto-related projects over the years.

NFT collectibles that existed before the sector gained popularity are mostly regarded as digital assets with greater value over others.

- On-Chain or Off-Chain

NFT collectibles based on-chain imply that the token’s metadata is added to the network’s smart contract they are hosted on. This also provides a level of confirmation that they will exist as long as the blockchain is still in existence.

In contrast, off-chain NFT collectibles are tokens that have their metadata stored separately due to storage constraints. On-Chain NFT collectibles are more valuable than those launched off-chain.

- Background Information of the Project

The historical details of the project’s developers need to be taken into account. Nobody wants to invest in an NFT established by developers with questionable characters. Doing this is risky, as they may act in any way possible to enrich themselves to the detriment of investors.

- Scarcity

Even though there may be different items in a collection, those with rarity are considered more valuable than others. Hence, acquiring them is usually more expensive than buying any random item in the collection.

Top NFT Trading Strategies

The goal of trading NFTs has always been to make huge returns. While there are several techniques that can help you achieve this goal, we’ve selected the five best NFT trading strategies to guide your investment choices:

Buy the Floor

Non-fungible tokens are still gaining popularity and chances are they will continue to exist for as long as possible. With this in mind, you may consider buying NFTs at their floor price. Floor prices in the NFT market represent the lowest price of a non-fungible token within a given category.

Although it is not advisable to purchase the NFT only because it has a low price, you should opt for a project based on a category of interest to you. For instance, you may choose rare NFTs over others and select the token with a floor price within that category.

Buying the floor is a good trading strategy that positions you for enormous growth should the token become more popular in the future.

In simple terms, buying the floors helps you secure an early seat in the token’s journey to higher growth.

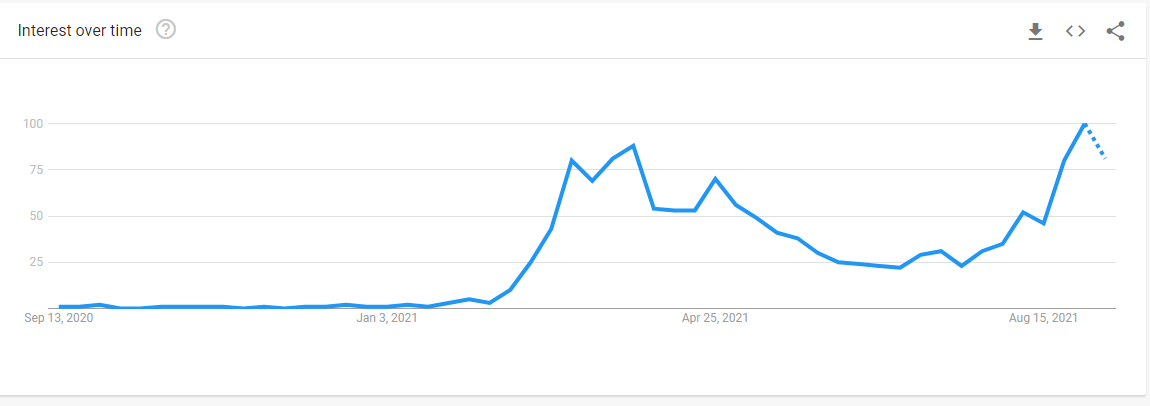

Search for NFT’s Google Trends

Source: Google Trends

It doesn’t matter whether you are new to NFTs, you can easily determine if the market is still a hot niche by checking its Google trend.

The Google trend is used to measure public opinion toward a particular topic or keyword and searches for the word are scaled in a range of 0 to 100. When the rating is high, it indicates that many people are getting involved with NFT collectibles and it indirectly signifies a good buy time.

However, when the search for NFT-related keywords is low, it means you will need to tread carefully as fewer people are showing interest in the market.

Buy NFT Collectibles With Few Sellers

When there are many sellers for an NFT collectible, it is always difficult to sell the token unless you are willing to dispose of your holdings at a relatively low price. This could reduce your profit by a significant margin.

If you’re considering selling an NFT that has many sellers, examine the sellers’ already listed prices to identify whether they are placed above recently completed sales.

Also check the space between the listed sale prices to see if the sellers are impatient to sell at any given price. If the prices are close together, it means that the sellers may react quickly to lower their price if you place a sale order lower than theirs, thus causing the asset’s value to crash even further.

Value Strategy

You should consider buying NFTs that are regarded as highly valuable. In order to identify an NFT of value, you will need an online tool like Rarity.tool, which compares different NFT projects based on how rare they are over others.

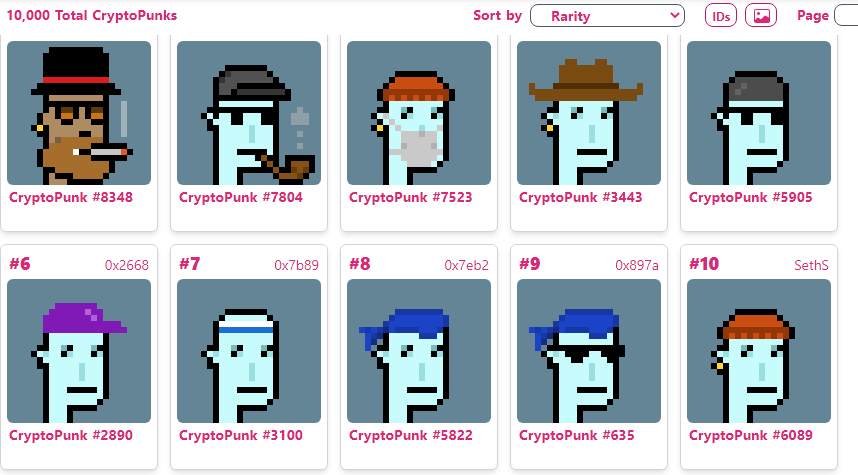

Even though there are 10,000 CryptoPunks selling at high prices, the ones in the image below are considered the more rare, because they have features that other punks in the collection do not have.

When an NFT collectible is rare, there is a better chance of an increase in value as its demand would always outweigh its supply.

Buy the Ceiling

Ceiling NFTs are rare, expensive, and highly popular assets. These are mostly investment choices for traders who have lots of cash to spare. These NFTs have huge prospects for growth, especially when popular figures like celebrities or influencers get involved with them.

One major challenge with ceiling NFTs is that only a handful of people can afford them since the prices are relatively high. When their popularity diminishes, ceiling traders may record huge losses as they may opt to sell at giveaway prices.

Tips for NFT Traders

Have a Motive for Each Trade: You should understand why you’re buying the NFT to help you stay committed irrespective of the market movement.

Learn Trading Fundamentals: You may think of tokens as some kind of new tech that requires absolutely new approaches. However, the truth is that nothing is new under the sun, people that engage in trading tokens are mostly consist of a same type of players that day-trading in the stock market. Therefore you can raise your edge over the average market paricipant by thoroughly studying trading fundamentals and improving your overall trading literacy.

Only invest What You Can Afford to Lose: Do not get carried away with intentions to make huge gains that you decide to invest more than you can afford to lose. NFTs are highly risky and nothing is promised to anyone. An asset may dip by more than 50% in a matter of hours based on several reasons, including regulatory sanction on the crypto space.

Trade Tokens With Good Prospects: In all you do, put in the hard work by conducting due diligence to determine which NFT has good potential for growth. You can combine different techniques highlighted in this article like using Rarity.tool to compare the projects that are rare with other similar ones.

Enter Early: Do not wait until a project is on every social media platform before you choose to buy it as you may be buying at a relatively high price. Be the early bird that catches the worm by conducting due diligence on available NFTs and buying the tokens when too many people still don’t know about them.

Diversify Your Investment: Do not put all your capital into one NFT project. Carefully spread your capital to at least two to three NFTs so that should a token dip, you will not be totally stranded as other collectibles will cover up for you.

Conclusion

This article shared five NFT trading strategies that will help you succeed. Regardless of how easy the points listed in this article may seem, do not get carried away as NFT is similar to other crypto sectors, which pose significant risks.

Do well to conduct due diligence on the listed strategies to identify the method that works for you. You may also decide to combine more than one trading strategy to increase your chances of winning in the market.