NFTs are the special class of digital assets that are taking the internet by the storm. If the internet is going crazy for NFT tokens, then it is worth understanding what they are and why they are valuable.

Table of Contents

This article will provide you with a deep understanding of what NFTs are, how you can benefit from the market, and the downsides to trading them.

What is NFT Art?

NFT, short for non-fungible token, is a digital representation of any item including collectible sports cards, virtual lands, and digital pieces of art.

NFT art refers to digital assets that represent various artworks such as videos, music, gifs, games, text, and memes. It is a registration of the ownership of a particular artwork on the decentralized ledger network — blockchain technology.

These tokens are unique, with each containing distinguishing information that makes it both different from other similar NFTs but easily verifiable on the blockchain.

Recently, though, NFT arts are becoming very popular, with celebrities and influential figures joining the trend.

What is so special about them and what drives their value?

Why Do They Have Value?

Like every other speculative market, the value of NFTs is largely affected by the forces of demand and supply. The thrill of getting a coveted piece of digital art drives the value of the piece.

The scarcity and degree of uniqueness of a particular NFT token make an increase in its demand by collectors and investors who are often willing to pay lots of money to purchase it.

Now, we have seen what gives NFTs their value, however, what do people get when they buy these tokens?

What Exactly Do You Get When You Buy an NFT?

The question of what you are actually buying when it comes to NFTs is one of the biggest questions investors have concerning non-fungible tokens.

While some argue that you are buying an item representing the internet sensation at a time, others claim that you are obtaining the property rights to the item.

However, the truth is that you are neither buying just that piece of digital art nor the copyright to the artwork.

Surprised? Don’t be.

For one thing, when you buy an NFT, you are not just buying that piece of digital art. NFT arts exist as either visual or audio-visual items.

In that case, anyone on the internet can view them at any time and can even download them on their electronic devices free of charge.

So, if you are buying just that picture or video of a piece of crypto art, it is pointless because someone else somewhere else can just save the image or video for free.

Next, you are also not buying the copyright to the item. Shocker, not all NFTs are authentic. Some are just reprints of the original piece of art. Just because you hold that piece of NFT does not mean that there are no other versions of it elsewhere.

To make it even more difficult, there is no way that you can visually differentiate between an original crypto art and the copied version of it.

What then are you buying?

Simply put, you are buying a code that gives you the property rights to the NFT. Yes, what you are buying is not a picture or a video but a unique code that identifies you as the rightful owner of the digital art irrespective of how many versions of it there are in existence.

The token has a unique barcode on the blockchain upon which it was built and once it is added to the blockchain, the ownership of the token is public and transparent.

Therefore, when you are purchasing an NFT, remember that you are buying a certificate of authenticity, a bar code that can prove that you have sole rights to a unique version of the digital art token.

How To Make Money With Non-fungible Tokens

Since NFTs can not be directly exchanged with each other, like other fungible tokens such as bitcoin, methods of making money with them are very unique.

These NFTs are stored on the underlying blockchain technology, making the proof of ownership very transparent. NFTs are traded on various marketplaces created for the sale of such tokens.

There are two primary ways that you can make money while trading NFTs. They are:

1. The Creators/Artists

NFT creators are at the top of the chain. Without creators, there would not be anything to buy or sell. These artists create the NFTs using choice characteristics.

While it is true that conventional artists do not often earn more from their works even when the value appreciates, NFT creators have the privilege of making money from their crypto art on life-time resales.

One way that digital art creators can make money from non-fungible tokens is by programming royalties into their crypto art. These royalties allow them to receive certain percentages of the sales profit every single time their artwork is resold.

The percentages, which are typically set between 2.5% to 15%, ensure that the creator receives part of the interest from sales as long as the NFT exists.

Additionally, creators get to keep a greater part of the money realized from the sale of their artworks. They do not need to rely on auction houses and art galleries to sell their digital art since the marketplace serves a global audience.

However, most platforms require that creators spend some money to list their artworks for sale. Therefore, it is very important to create quality digital art that would drive a lot of sales, if not you end up losing money yourself.

2. Collectors/Traders

This set of individuals in the marketplace are the reason for the current NFT boom. Without collectors or buyers, art creators can not sell their works.

These collectors build portfolios of collectible tokens that they like or feel that the price will increase in the future. They have the goal of making profits from the sale of these tokens that they accumulate.

Collectors/ traders can obtain their desired NFTs on the peer-to-peer marketplace and either sell soon or choose to hold onto it with the hope that its value will increase over time.

At times, NFT sales can go crazy and cause the already existing speculations in the market to go higher. Let’s take a look at just a few of the most popular NFT drops.

The Most Popular NFT Drops

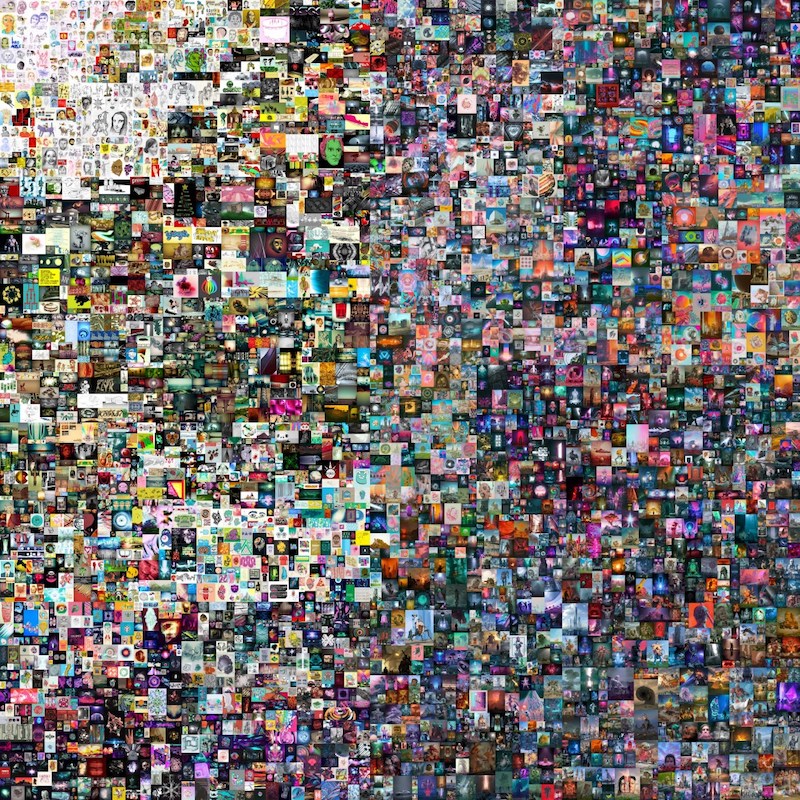

The 254-year-old auction house Christie’s recently conducted its very first digital-only art auction. The auction for a digital art collage made by the artist Mike Winklemann, popularly known as Beeple lasted for two weeks.

The digital artwork is a collection of Beeple’s individual crypto art for the first 5,000 days (13 years) of his career as an artist.

At the end of the auction, Beeple’s work was sold for over $69 million, putting the artist among the top three most valuable living artists.

Twitter’s co-founder, Jack Dorsey has also listed some of his very first tweets as NFTs for sale on the platform for selling tweets. Bids for Dorsey’s are already reaching $2.5m.

Additionally, the collectible sports card platform, NBA Top Shot, is also witnessing a crazy amount of sales. The NFT marketplace for the sale of coveted NBA highlights known as “Moments” is fast-raking up figures for itself.

In less than one year since its launch, the peer-to-peer NFT marketplace has accumulated more than $230 million in sales. The latest pack drop sold for a record $1.05 million.

The Future of NFTs

Since the launch of the first set of Ethereum-based NFTs in 2017, the CryptoPunks, the entire digital arts marketplace has continued to show consistent growth.

With over $300 million worth of assets sold, the market is set to disrupt several other industries apart from art as more and more people are becoming aware of their potential.

As many more creators recognize the benefits they stand to gain if they tokenize their works, then, it is fair to say that NFTs would become the digital haven for collectors.

NFTs are gradually progressing to a point where they would become the standard for real-world collectibles.

Advantages And Disadvantages of NFT

Why are people so hyped up about NFTs? What are the downsides to it? We will now look at some of the things that attract a lot of people to the NFT scene as well as things that make it unappealing to others.

Advantages Of NFTs

Several features make non-fungible tokens appealing to investors and creators alike. They include

Authenticity: Blockchain technology creates a validation that is not present in physical collectibles. It is impossible to create inauthentic replicas of crypto art on the blockchain.

Additionally, the property rights or proof of ownership can not be changed no matter how many times the crypto collectible is sold since it is added to the immutable and permanent decentralized ledger.

Easily Transferable: NFTs can easily be transferred to anyone, anywhere in the world. The peer-to-peer marketplace makes it possible for buyers and sellers from different parts of the world to meet and conduct trades.

Unique and Limited: The uniqueness of certain NFTs is perhaps the most appealing quality that it has. The degree of scarcity of a particular crypto collectible is one of the major propellants of its value.

Disadvantages Of NFTs

While it is true that NFTs have several appealing qualities, there are downsides to them as well. The disadvantages include

Environmental Impact: The explosion of NFT minting via proof-of-work blockchains like Ethereum can negatively affect the environment. Large computing power is needed to operate the underlying blockchain upon which several NFTs are built.

While there are plans to stop the Ethereum blockchain from being energy intensive, a single transaction currently takes up more power than the amount required for average household use in a single day.

Indivisible: Unlike fungible tokens, most NFTs can not be split into smaller units. While this is favorable to some people, especially art collectors, it is unfavorable to others.

It does not foster inclusion as those who do not have enough money to buy the full token can not participate in the market. It also makes it possible for those holding it to inflate the price as much as they want.

Highly Speculative: The current frenzy in the NFT market has led some analysts to conclude that it might just be another speculative bubble that is set to burst when the enthusiasm dies down. If such happens, so many people will lose their funds.

Exploitation: The ability to create NFTs at will, especially on free and public self-serve platforms, has led many people to exploit some upcoming artists. The anonymity that exists on the blockchain makes it impossible to detect if the creator of digital art is the actual owner of the artwork.

Conclusion

Although the NFT market is not yet stabilized, it is gradually becoming a quite interesting offshoot of the crypto and blockchain industry. With the level of interest that it is currently receiving from investors and collectors alike, it may well be on its way to massive adoption.

However, in the end, we will have to wait and see whether NFTs live up to the hype and subsequently become a significant part of the future collectibles market. They have the potential to grow, so their growth and development would be very exciting to watch.